Tuesday April 5, 2022

By Shirley Ju

News

News

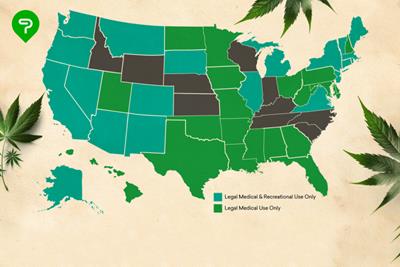

From the outside in, it may seem like the cannabis industry is flourishing. Weed is legal in 13 states across America, people are starting to understand and see the flower’s medicinal benefits, and there’s a dispensary every few blocks (at least in Los Angeles where I reside).

What people don’t understand is the amount of crippling taxes that these cannabis companies are having to pay a whopping 15% excise tax, a cultivation tax at $161 a pound, sales tax that varies between 8-10%, and depending on the city there can be an additional 15% in local tax which can add up to 45% taxes at minimum for all purchasers of cannabis or cannabis products sold at retail.

As California is currently considering cannabis tax reform bills, there have been a few cities such as Long Beach that are taking charge in providing tax relief at the local level. Last week, the Long Beach City Council voted unanimously to investigate cutting the city’s cannabis cultivation tax which currently charges business owners $12 a square foot on top of the state’s cultivation costs. Within the next 90 days, the city’s Oversight Committee will determine if a tax cut is possible and by how much.

Long Beach Cannabis Tax Reform Rally

Elliot Lewis, CEO of Catalyst Cannabis Co. and one of the retailers who helped organize the Long Beach Rise Up! cannabis tax reform rally that took place in front of Long Beach City Hall last month states:

“This is a great first step in helping Long Beach Farmers. My hats off to city council and Al Austin for having the balls to lead on this item. There is still work to do to get the cultivation item fully into law….and beyond that much work to do at the state and a look at reducing retail taxes are still on the forefront of my kind.

Equal treatment under the law is what the cannabis industry is entitled to. And I won’t stop fighting until we get all the way there….

but for now I bask in any progress and am humbled and grateful that we could uplift our local farmers and the mother fucking LBC cannabis culture.“

This cannabis tax reform rally, which was a call to lawmakers in Sacramento to act, is one of the many ways cannabis industry figures are making their voices heard. California could be facing a farmer extinction event and with the tax imposed on the legal businesses as they cannot compete with the illicit market that continues to thrive.

Over 200 people came out to support the rally, marching up and down Ocean Boulevard. chanting, "Up with Access Down with Taxes" and “Weed for the People”! This serves as part of the statewide initiative in lowering taxes in the legal cannabis industry.

Influential Speakers and Cannabis Advocates

Brett Feldman

Brett Feldman is the founder of Wonderbrett, a popular cannabis brand and legacy cultivator, who spoke on how the cultivation tax greatly affects marijuana farmers and lowers their profitability to just break even.

“I’ve been in this space for a long time, it’s not going to last the way it’s going. This is more dire than anyone realizes. The major issue is there is a huge trap being sprung on the people of California and all the people that dreamed of cannabis going legal. People voted so they didn’t have to see their family members go to jail, they didn’t vote to be taxed to death. There is no hope for survival for brands and especially the farms.

Me having a brand is the only way we are surviving, if I just had my cultivation operations, there would be no way for us to survive. Now you have everyone paying on terms because of the tax situation. So if I give out product to someone on terms and it takes 30-90 days to get paid but the state wants to excise tax so now if the account doesn’t pay that bill we still end up paying money to the state for these pounds that we never collect on. We don’t get tax write-offs, no business can survive this way. It’s just impossible and part of this system they created is doomed to fail.”

Tamika Wagner

CEO of Canna-Xpress, Tamika Wagner, is the first and only minority & family owned Social Equity Microbusiness currently operating in Long Beach, CA. They went through a rough period of homelessness. She states that cannabis brought her out of poverty and because of the tax, it could now put her back there. For small minority operators the tax makes access to entry and running a profitable small business in the cannabis industry nearly impossible.

“I am the first minority woman, 100% family owned, social equity operator in the city of Long Beach. My family is from Long Beach and was homeless in Long Beach, cannabis lifted us up out of poverty. As the price of cannabis flower and raw goods continues to drop, the taxes are scheduled to increase and remain fixed, that’s a problem. These taxes are squeezing out the already small profit margins for everyone across the state and affecting all types of cannabis license holders.

Our demand is this; we need a change and opportunity in sustainability. If we are left on the current trajectory we will not survive, we will not be here, especially social equity businesses.”

Corvain Cooper

Corvian Cooper, founder of 40 Tons, was sentenced to life for non-violent cannabis charges and spoke on behalf of Last Prisoners Project. The last administration commuted his sentence before leaving office. He was set to live the rest of his life in prison before getting out and served a total of 9 years. He spoke on the importance of expungement and the unjust sentences to those who are still in jail for what is now a legal industry.

“These heavy taxes are forcing consumers and businesses back into the black market. When you talk about the black market, that is the way I got a life sentence. It’s been a total 360 turn-around. I have been out a year and I’m one of the last people that Trump let out. Since then we have created this brand called 40 Tons and I’m not supposed to be here speaking to you today. I was supposed to die in prison for the same plant that has helped people across the nation.

It’s still federally not legal so technically you can still get a life sentence for this today, just because you see a store on every corner does not mean it can’t still affect your life. That is why expungement clinics are so important and we want to team up with Catalyst on their expungement clinics because people don’t know that if you are caught with any illegal substance and it’s three strikes, you can still get a life sentence today.

I’m so glad everyone came out together, we are all on the same page, we all know that we can’t build anything if we don’t stick together. For instance, right now we are advocating for a young man named “Daniel” who is about to turn himself in for a 5-year sentence on cannabis charges, so this is still going on today. Free all the guys that are behind the wall!”

Samantha Kohler

Director of Catalyst Cares, Samantha Kohler, spoke on the experience of losing her job during covid and making an industry switch to cannabis. As a union employee of Catalyst Cannabis Co., she received more benefits and pay than at her last job. Starting as a receptionist she worked her way up the ladder to lead community outreach efforts through the company through Catalyst Cares. Kohler mentions the 300,000 jobs that are at risk because of the state’s exorbitant taxes that directly affects their ability to hire and expand their footprint.

Elliot Lewis

Elliot Lewis who is CEO at Catalyst Cannabis Co. is a longtime advocate for fair tax reform who closed out the speeches with remarks echoing hopes that Sacramento hears the cry of the legal market as they try to stay afloat. After his remarks, Lewis then led a march down Ocean Boulevard, garnering support from rally participants and passing by drivers supporting the cause.

Hopes are high in California that taxes will be reduced on cannabis businesses.

Let us know what thoughts you have about the tax reform and social equity in California below!

Photo Credit: Nathan Avila