Tuesday April 30, 2019

By Andrew Ward

News

News

Canada’s adult use cannabis marketplaces and laws officially went into effect nationwide on October 17, 2018. Since then, the nation has offered a glimpse into what a nationally legalized cannabis marketplace looks like. In the months since its launch, the results have been mixed, to say the least. While the Great White North continues to assert itself as a dominant player across the globe, its sales back home suggest that regulations, product shortages and other hurdles continue to sway citizens from purchasing from the legal market.

Here is how Canada’s market has fared in the months since legalization went into effect.

Sales Figures and Supply Issue Struggles

In the first full month of legal the marketplace, Canadians totaled $54 million in cannabis purchases. However, sales had declined .9 percent from the October sales, which only ran half the month. The early months of sales provided retailers with headaches surrounding a lack of supply and provincial laws limiting regions like Ontario from opening up dispensaries. Instead, citizens had to purchase cannabis through a government-run website (dispensaries in Ontario have since opened for business). Like Canada as a whole, the province saw its first full month sales decline from October's, noting a shift from $11.7 million in sales in October to $10.1 in November.

Since the initial months of sales, Canada’s cannabis market has found itself with a series of pressing issues across the nation. Online sales have deterred some in Ontario. Meanwhile, the same is happening in Quebec where 80 percent of its revenue came from brick and mortar sales despite the more convenient online option. The figures were even higher in Nova Scotia (94 percent) and New Brunswick (95 percent). Figures from early 2019 also revealed that Atlantic Canadians bought more cannabis per capita than the rest of Canada. The report found that Prince Edward Island spent the most on average, with $21.95 spent on legal pot purchases. Nova Scotia came in second spending an average of $17.87 on each purchase.

By March of 2019, supply issues were mostly in the rearview mirror. However, a decline in sales continues to occur. Ontario recent introduction of brick and mortar sales in early April will provide some bump, as will the sales of edibles and concentrates beginning next October. However, for now, the nation continues to see its sales decline while the black market continues on.

Cannabis Consumption Varies Across Canada

While Prince Edward Island spent the most per purchase, it falls second on the list of consuming the most cannabis per capita. Nova Scotians consumed the most cannabis at a total of 27.1 grams per person each year. Over the fourth quarter of 2018, Statistics Canada found that 21.9% of the province consumed marijuana of some kind. Newfoundland and Labrador came in second with 19.2% consuming over the period. New Brunswick (18.9%) and Prince Edward Island (17.9%) also ranked at the top of the list. Meanwhile, Quebec had the lowest per capita usage over the period, with just 13.6% of citizens consuming.

During the fourth quarter, Statistics Canada found that ages 15 to 24 used cannabis the most at 27.4% while the number fell steadily as the age demographics increased. Overall, men consumed more than women with 19.4% of men using cannabis during the quarter while only 11.3% of women did the same.

Looking at the Law

The laws surrounding adult use marijuana continue to evolve in Canada as they have in plenty of United States markets. Some changes have been met with positivity while others have sparked doubt in the direction of the law. In March, Health Canada noted an issue with one-click authentications on websites and social media. In its current form, Health Canada argues that minors can access promotions meant for adults. Under the existing law, a company cannot promote anything that may be targeted at youth.

Another issue that has caused plenty of frustration is taxes. States like California have highlighted the struggles that come with strict regulations and taxes. Up North, a plan to apply taxes on new products based on THC content could see consumers paying more for their products. The proposal calls for a one cent tax on each milligram of THC in edibles, extracts and topicals when they hit sales shelves later this year. Those against the measure believe it impacts medical patients who need higher THC products to treat their medical conditions.

Criminal justice reform continues to be a discussion as well. While the government has made efforts to pardon simple marijuana possessions prior to legalization, cannabis proponents say it was the bare minimum that could be made. While the measure removes the five to 10 year waiting period a Canadian must wait for a pardon, it fails to provide the same option to the majority of cannabis offenders in the nation.

Where Does Canada’s Cannabis Market Go Next?

While recreational sales may continue to slide in the coming months, Canada still has plenty to see as positive gains in the market. Namely, its presence in the global cannabis market. Canada's first to market advantage has allowed numerous brands to establish themselves domestically before launching into the global market.

This includes medical cannabis exports, which tripled last year. In 2017, the nation shipped out 522 kilograms of dried cannabis. In 2018, the amount leaped to 1,465 kilograms. The same can be said for oil which jumped from 435 kilograms in 2017 to 919 in 2018. The rise is primarily credited towards the race to solidify supremacy in the burgeoning European medical market.

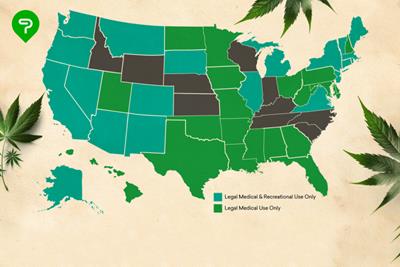

International gains do offer a lucrative glimpse into Canada’s cannabis market and prospects. However, its struggles back home mirror pain points certain U.S. states have encountered as well. But with the struggle occurring across the nation, a pause for concern may be warranted. That said, the Canadian market is likely going through growing pains which should be remedied as the market matures and corrections are made to specific regulations.

What are your thoughts on Canada’s legal cannabis market? Share your input below!

Photo Credit: Ndispensable (license)