Thursday May 31, 2018

By Andrew Ward

News

News

Recent data reveals that a growing number of financial institutions are open to banking with the marijuana industry. This changes a long-standing policy by banks that have to adhere to federal regulations. The number of participating locations remains at just a few hundred today, but the news proves positive regardless.

Currently, American canna-business owners have limited banking options. Often, they resort to tactics that haven’t been prevalent in legal businesses since the Great Depression. Changes have begun to come on the horizon. Banks, government regulation and pressure from a growing number of legal states might change the status quo.

If the trend continues to gain steam, the validity of the cannabis market in America and the world trends upward as well. The coming months and years will prove pivotal to the direction it takes. Here’s where the situation stands today.

History of Banking and Cannabis

It’s rarely, if ever suggested that one does their banking by putting money under a mattress. That is, unless you happen to run an American marijuana dispensary. One marijuana packaging business owner told the L.A. Times about her exchange with an accountant:

"I was told by an accountant, who closed his door to tell me this, that you just keep your cash under the mattress," Gosnell said. "Stash it somewhere and find a way to get a big deposit into your account. I said that doesn't sound legal, but I am told everyone operates this way."

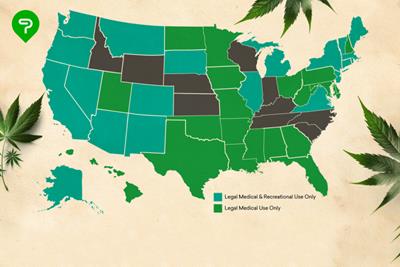

That’s the case for an estimated 70% of American cannabis business owners today. This is due in large part to the Federal Controlled Substance Act (FSCA) that blocks banks from dealing with controlled substances. As marijuana is a schedule 1 narcotic, marijuana businesses almost always have to work in abstract terms and vague descriptions. That puts them right in the crosshairs of federal banking regulations, which a bank must report to authorities once it has been detected. Some state financial institutions and credit unions have taken on cannabis banking, but must remain cash only to avoid federal oversight.

The fact that a billion dollar industry is left to largely fend for itself, risking businesses, large sums of money, livelihoods and sometimes even lives, is an issue that needs imperative addressing.

Notwithstanding the wavering feelings of President Trump and the antiquated views of Attorney General Sessions, marijuana in America moves on. The history between cannabis and the U.S. government has always been questionable, if not more.

As the market continues to boom, banks might finally be able on board with canna-banking. Will the government follow suit?

Banks New Willingness That Comes at a Needed Cost

Despite the mixed messages from Washington, a growing number of banks are opening their doors to the cannabis sector. Financial Crimes Enforcement Network (FinCEN) data shows that the number of financial services jumped from 340 to 400 between January and September.

Local Banks Enter the Fray...

January 3rd marked the opening of one of the first banks to accept medical cannabis business in Maryland. The process began for Severn Bank back in 2013 when the state legalized medical marijuana. Severn could be joined soon by other banks that plan to use 2014 federal guidelines which allow banks to take qualifying steps with businesses in legalized states. How this will be affected by the current administration remains unclear.

...But Don’t Tell Anyone

While the banks are opening their doors to cannabis, they're not being boastful about it – for now. Severn Bank, for example, is discrete about its gains in quarterly filings and onboarding fees. Instead of listing its deposit growth as marijuana, it is described as a "campaign designed to attract deposits in certain local emerging markets" and "onboarding fees received on a new deposit product."

Downside to Cannabis Banking...

It pays to have a bank account, but you'll also pay dearly to have one. A cannabis industry bank account functions differently than a traditional bank service that comes with little to no fees. Banks have to do due diligence on all their accounts. When a company profits from marijuana, the due diligence escalates greatly. In turn, the banks charge these depositors with upfront fees and larger monthly payments.

The need for additional monthly bank costs are justified when account holders in the business have to provide the bank with daily accounting of sales and other financial details. One Severn Bank cannabis owner reported paying $3,000 in upfront costs and $1,700 each month and can only operate in cash to avoid the feds.

...But the Alternative Isn’t Better

A bank account is immensely beneficial to the cannabis industry despite the high costs and limited functionality. While the need for reform is glaring, the current situation would be enough if accessible to the 70% of businesses left banking their own cash. California alone stands to bring in billions in its first year of legalized sales. That only expands the problem in California and other states have operated as cash only enterprises for years.

The banking embargo leaves owners storing all their earnings in locked safes and other undesirable depositing areas. In 2012, an Orange County dispensary owner was kidnapped and tortured by thieves in an attempt to steal the business’ earnings. This past December, California began steps to curb the issue with a green banking plan that hopes to ease the problem.

Future Looking Bright for Better Access and Regulation

Political support has never been stronger in America. Today, the bipartisan Cannabis Caucus is in its early years in Congress. It’s now common to hear credible candidates pushing for legalization efforts as well. Congress also recently saw the introduction of H.R. 1227. Introduced by Republican Thomas Garrett and 15 others, it calls for marijuana to be struck from its Schedule 1 status.

Arguably the most significant sign might not have come from regulations at all. Instead, it came from Attorney General Sessions’ decision to roll back the Cole Memo. A resounding pushback from legalized states, including numerous Republican Governors, was quickly made. This has led some to ask if the AG’s decision may actually expedite marijuana legalization. Even cannabis-reluctant New York Governor Andrew Cuomo called for a study into adult use in the state. With neighboring states New Jersey and Massachusetts already involved in the market, and New Jersey rumored to join Massachusetts and legalize soon, New York could lose millions if it doesn’t.

Other states could find themselves in similar situations. Between optimistic regulatory proposals and neighboring state revenue pressure, marijuana’s future could become more legal. If so, the pressure to change banking only intensifies that much more.

Do you think cannabis businesses should have access to legal banking? Why or why not?