Saturday May 5, 2018

News

News

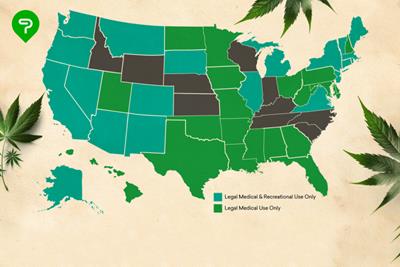

In 2014, the legalization of recreational cannabis virtually created a new market overnight. By the end 2017, the US market reached $10 billion in sales and experts expect that number to jump to $31 billion by 2021. Given that cannabis is the United States’ fastest growing market, and that the cannabis industry is projected to add more jobs than manufacturing next year, that numbers is likely a conservative estimate. As a comparison, early projections estimated sales for 2017 at around $5.5 billion.

So, if it’s already clear cannabis is going to be big, the question remains, how big will it get? As it currently stands, cannabis is poised to challenge some of the world’s largest industries, primarily tobacco, pharmaceuticals, and alcohol.

How Will Cannabis Compete with Big Business?

So, how is marijuana going to challenge other big industries when relative to such competition, cannabis’ $10 billion appears as a molehill next to mountains? Excluding China’s state-run tobacco company, the global tobacco market did $150 billion in sales in 2016. Total alcoholic beverage sales in the United States alone amounted to approximately $223.2 billion in the same year. CNBC reported that U.S. spending on prescription medicines in 2016 was $450 billion based on list prices, and $323 billion when adjusted for discounts and rebates.

Despite the current market gaps, there are a few large caveats to understanding the real size and potential of the cannabis market. Plainly put, cannabis is bigger than it seems and isn’t as big as other markets because it is actively held back.

Cannabis Banking

The first factor to understanding cannabis’ true size is to grasp that this $10 billion industry is an all-cash or nearly all-cash market. Cannabis succeeds in a modern market using archaic rules.

Federal banking restrictions keep most of the industry from operating like regular businesses, which means difficulty gaining access to banking services like electronic transactions, bank accounts and lines of credit. It’s difficult to see how largely this impacts the industry until one considers the extreme logistics of continually, safely, counting, transporting, storing and transacting large quantities of cash.

Cash is wildly inefficient for doing business on a large scale. Countless man-hours are required, and subsequently paid, to address the management of cash alone, deeply cutting into cannabis business’ revenues. The standard 3% fee paid to credit transactions palls in comparison.

Additional Taxes

Revenue for cannabis businesses is additionally depleted to taxes in ways unseen in other markets. Many dispensaries pay up to 70% taxes due to federal guidelines keeping them from participating in traditional business tax credits and programs.

Furthermore, without banking services, most dispensaries can’t offer normal credit or debit transactions to customers. This hurts business in another unforeseen way, as people spend more when using cards over cash. The most popular study says between 12-18% more, while others suggest as high an increase as 30%. This is further exacerbated by cannabis’ tightly restricted access on a national and global scale.

It is difficult to imagine how much smaller pharmaceuticals, tobacco, or alcohol would be as industries given the same restraints, or how much more dominating cannabis would be without them. These industries are doing everything in their power to not find out. Along with private prison corporations and prison guard unions, the three sectors make up the largest contributors to anti-cannabis lobbying.

When Will the Playing Field be Leveled?

The days of artificial restrictions on the cannabis market are likely numbered. And despite our administration’s official stances against the progress of cannabis, more and more states are considering progressive cannabis reform in 2018.

As far as banking woes go, community credit unions have been stepping in where banks won’t. In a major progressive step, Fourth Corner Credit Union, created with the sole intention of supporting legal cannabis businesses, won approval for a master account with the Federal Reserve this past February. This is the sort of account needed to make official transactions between banking entities, and a first major step in leveling the playing field.

The Attorney General’s decision to rescind the Cole Memo makes the continued success of such projects unknown, but for the moment, things seem hopeful.

Numerous fin-tech start-ups have emerged to creatively solve the cash crisis, and some dispensaries are even transacting through alternative means like cryptocurrency. In the near future, using a service like PayPal to purchase your edibles might feel perfectly natural, while appeasing federal regulators by providing a safe and traceable ledger.

Marijuana’s Bright Future

As Denver, Nevada and other recreational states begin to explore social-use venues and spaces, the battle over cannabis as a staple in society, and by extension the economy, will become more and more heightened.

If regulators aim to keep drinking and smoking from happening on the same premises, we might see the advent of a “substances war.” Imagine a group of friends debating whether to go to a smoke club or a bar, when not all of them drink, and not all of them smoke. Who wins?

Early signs point to cannabis. A study by researchers at the University of Connecticut and Georgia State University showed that sales of alcoholic drinks fell in states with access to medical marijuana, and a 2016 report concluded the same for recreational states. Cannabiz Consumer Group recently published a study that 27% of beer drinkers stated they have substituted or would substitute a cannabis purchase over beer.

For the American opioid crisis, switching to cannabis might not affect only sales, it could save lives. Reuters reports, “that hospitalization rates for opioid painkiller dependence and abuse dropped on average 23 percent in states after marijuana was permitted for medicinal purposes […]. Hospitalization rates for opioid overdoses dropped 13 percent on average.”

Perhaps the largest proof that cannabis will be a hit is that the very industries it threatens are betting on it. Tobacco and beer industries have already started to make inroads to the cannabis market, with both making recent acquisitions in Canadian cannabis firms. As for pharmaceuticals, no current cannabis-derived pill has met FDA approval. However, three different firms have one in development. It’s clear that when widespread approval comes, the competition wants to be ready.

Do you think the cannabis industry will compete with other big industries like tobacco and alcohol? Share your thoughts below!