Wednesday November 30, 2016

By Matt Chatham

News

News

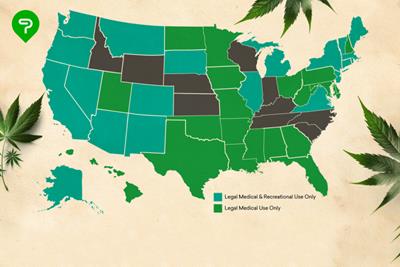

With a near sweep of the ballots this year and cannabis legislation passing in eight out of the nine states that voted, the clock is now ticking for lawmakers to establish proper measures for marijuana businesses and facilities to open up shop. An important part of those measures will be how taxes are invoked and what the structure behind them looks like, most notably in California, Maine, Nevada, and Massachusetts, who all voted to legalize adult use recreational marijuana. As we’ve seen in other states that have legalized recreational or medical marijuana, tax revenue from cannabis can have a major impact on the community and state economy. For a breakdown of tax information in the states with established adult use recreational marijuana measures, check out our previous article on marijuana taxes and what you should expect to pay when purchasing cannabis products.

More On the Economics and Politics of Cannabis Taxation

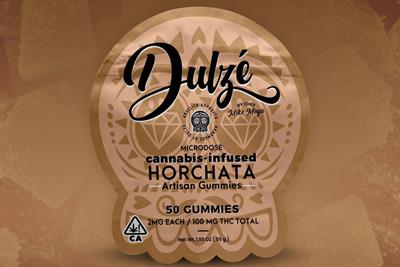

Although many academics have studied cannabis, including its economic aspects, until recently there were effectively zero legal marijuana markets for economists to study. What research has been done, therefore, has focused almost exclusively on illicit and medical markets, and there are many unknowns when it comes to legal adult-use markets. Nevertheless, “Considering the many unknowns and the new nature of all of this business, the forecasts were surprisingly not that far from actuals,” says Mazen Malik, Senior Economist at the Oregon Legislative Revenue Office. What poses a challenge for economists, he says, are new products such as edibles: “These products are primarily an outcome of legalization, and the way they will be accepted and priced is the biggest unknown.” (Obviously, edibles existed prior to legalization. Malik points out, however, that most consumers will prefer edibles from the legal market over “Kit-Kats from a shadowy figure on a street corner.”) State economists expect the infused product market to increase the market by about 10%, all told.

Photo credit: 401K 2012

One question which never had to be posed prior to legalization concerns the optimal tax rate on cannabis. Should all states adopt a 25-25-25 framework that Washington originally used? Or should they all go for Alaska’s $50/oz rule? The answer probably depends on the factors particular to each state, especially the strength of the black market compared to the legal market. An ideal tax rate, according to Malik, is one which “keeps the final product priced in a way that makes the black market less and less profitable and eventually squeezes out that parallel market altogether.” He goes on to say that, because legal cannabusinesses must deal with costly regulations and other standard business operating expenses, they begin at a disadvantage to the black market purely in terms of price. Therefore, the legal market must compete based on quality and other factors rather than price, at least initially. Consumers will pay more for the convenience, security, and safety of legal products over those purchased from an illicit dealer. As the black market begins lowering prices to compete with the regulated market, profit margins will diminish. This author would speculatively add that, since the legal market is able to invest in R&D in a manner unavailable or unattractive to the black market, over time we should expect to see the legal market becoming more competitive with the illicit market on both quality and price. Furthermore, legal markets are able to engage in targeted advertising, branding, and other business activities which will secure their advantage over the illicit market. Malik concludes with a prediction that, “if done right, the legal market can probably reduce the black market significantly in the coming 12 to 15 years.”

As the black market is squeezed out, says Adam Koh of Cannabis Benchmarks and 3C Consulting, current tax frameworks will have to be reconsidered since policymakers will no longer need to contemplate tax effects within a dual black-white market. Whether this will lead to increased or decreased taxation levels remains to be seen. (Matt Karnes at GreenWave Advisors expects taxes to come down before the black market is squeezed out, in order to make legal markets more competitive.) Since the black market will effectively no longer exist, legislators may decide to increase taxes and milk cannabis’ potential for “sin tax” revenues. On the other hand, by that time a powerful cannabis lobby may have grown and have the ability to block any such legislation. So far, according to Koh, the cannabis industry has been more or less accepting of their tax burden in order to secure the legitimacy of their business in the eyes of the public: “Business owners know that they need to pay their taxes to keep the support of those that are not necessarily 100% behind legalization. So, while cannabis industry groups lobby hard and publicly for things like more sensible banking regulation, taxes aren't really something that's questioned too much.”

Speaking of banking, be prepared to pay in cash for any marijuana products you buy. Because of federal rules, almost all banks refuse to touch cannabis businesses. This requires these firms to deal almost exclusively in cash, which poses issues both for security and for payment of taxes. Although Washington now requires businesses to pay taxes in some other form, many states see cannabis companies “turn in tens of thousands of dollars in cash,” according to Koh. Overall, the industry is hindered by its cash-based nature due to increased transaction costs (mostly inconvenience). With loosening federal regulations on the horizon and industry groups prioritizing sensible banking regulations, this may change very soon.

As mentioned above, the potential tax revenue has played a significant role in political rhetoric supporting legalization efforts. Whether this has played a significant role in shifting public opinions is unclear, though it certainly has not helped the opposition. Malik doubts that it has played a large role in changing official views on cannabis, for the simple reason that cannabis just doesn’t bring in much money. Recall that total revenues from cannabis barely exceeded 1% of total state revenues in Colorado. In Oregon revenues are even less, amounting to not even 1% of the state budget.

Koh has a different perspective regarding the effect of tax revenues on local governments, though he agrees in terms of state revenues. He points to the city (and county) of Pueblo in Colorado. “Pueblo is an area that had been economically depressed in recent decades due to the departure of the steel industry, so since 2014 they have been welcoming cannabis businesses,” he says. Thus, although revenues are insignificant to the state, some local governments may be able to capitalize on the new industry by welcoming businesses. They may thereby create a cannabis industry cluster, effectively securing a competitive niche within the industry compared to other regions.

What Are the Key Takeaways for the Average Consumer?

Much of the above may seem irrelevant to the average consumer. From the perspective of someone looking to purchase cannabis from a legal dispensary, particularly those who may be new to cannabis or buying outside of their home state, there are two key takeaways. First, understand that prices and taxes will differ significantly by state and locality. Because a national market for cannabis does not yet exist due to federal laws, each state has its own market. Each state also has its own taxation system, and localities within each state may impose further taxes that can significantly drive up the price. Second, be prepared to pay in cash. Many dispensaries have ATMs inside that you may use to withdraw funds, but it may be wise to have cash on hand before entering the store pesky fees.

Finally, stay informed about the laws of each. Idaho, directly adjacent to Oregon, has seen seizures of cannabis increase significantly since legalization, presumably due to Idahoans buying in Oregon and crossing back over the state border. At present, again due to federal laws, it is actually always illegal to carry cannabis across state lines, even if you are going between two states that have legalized. But if you do make that choice, make sure you know what you’re heading into.

Be wise, be safe, and enjoy your legal weed!

Photo credit: Meditations