Saturday July 27, 2019

By Erin Hiatt

News

News

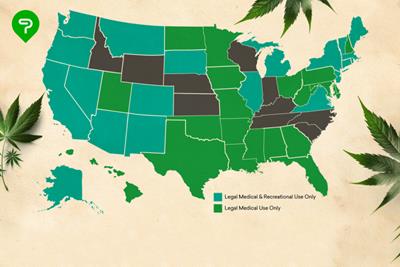

There is no doubt that Americans have grown more comfortable with cannabis. As adult-use states continue to tally up – with Illinois being the most recent to legalize via legislature – Americans have showed up in droves to vote for cannabis legalization measures throughout the country. Ten states and the District of Columbia now have legal adult-use laws, while another 22 states have some form of medical marijuana laws. All told, around 66 percent of Americans approve of cannabis legalization. Despite the proliferation of legal cannabis states, it remains a Schedule I drug under federal law, which can bring harsh punishment, and puts business owners operating in legal states at risk of arrest, asset forfeiture, and other penalties. Of the more insidious side effects of the War on Drugs, the disproportionate arrest and imprisonment of people of color for minor drug infractions remains an intractable problem, one that states like Illinois, California, and Massachusetts are working, in fits and starts, to correct.

As legal cannabis businesses continue to walk a precarious tightrope between state and federal law, cannabis investors, many of whom are new to an industry slowly emerging from its black market past, are plowing full steam ahead. Cannabis investment and market research firms The Arcview Group and BDS Analytics recently predicted that global spending on legal cannabis is expected to grow an eye-popping 230 percent to $31.3 billion in 2022, up from a mere $9.5 billion in 2017. No wonder anyone with a few extra bucks in their pocket is considering investing in a pot stock. But, just because you can, does that mean you should?

The Upside of Cannabis Investments

As previously mentioned, the legal cannabis industry is growing – pun intended – like crazy. The federal government also seems to be relaxing their stance a bit when it comes to enforcement of marijuana laws, as demonstrated by the recent passage in the House of Representatives to protect state legal cannabis programs, which makes investors more bullish about pot stocks. And investment opportunities abound. Not only are there “plant touching” companies whose work involves growing and distributing the herb, but there are investment opportunities in ancillary cannabis businesses that provide equipment and supplies, pharma and biotech companies doing research on medicinal applications, and real estate, technology, and consulting businesses.

Now that our neighbor to the north, Canada, has legalized cannabis, many American companies have, or are making an attempt, to get listed on the Canadian Stock Exchange (CSE), so they can “go public,” which would enable them to make their shares available for purchase by the public. The Motley Fool writes about cannabis investments, “there is a possibility that the global marijuana market will more than triple from 2018 to the end of 2022. There will be probably be several big winners from this sizzling growth. Investors who accurately pick those winners should be set for some fantastic returns over the next few years.”

The Downside to Marijuana Stocks

The first risk of investing in a marijuana stock is that all the hype and projections of what seems to be practically unlimited market growth might never materialize. The second risk is that the federal government could decide to crack down on legal states, staunching any further growth. And, the illicit market lingers even in states where cannabis is legal, because prices are often lower on the black market than they are in legal operations. If a U.S. company cannot yet afford to list their company on the CSE or meet the stringent requirements of the U.S.’ NASDAQ market, they can always list on a largely unregulated market called the Over the Counter (OTC) Market. Often referred to as the pink sheets or penny stocks, many investors remain skeptical of the OTC because of its lack of transparency and dearth of regulations. Investors with a high tolerance for risk may find the OTC market palatable, while others find it too risky. Another potential barrier to high returns on cannabis stocks is that some investors may find them generally unpalatable and categorize them along other so-called “sin stocks” like tobacco, alcohol, and oil.

There are a few factors investors should consider before jumping into marijuana stocks. Market research, e.g. cost structures for farmers, or industry competitors should be conducted, just like with any other stock. Other things to keep in mind are things like price-to-earnings ratios, which measures a company’s current share price relative to its per share earnings, and the enterprise value of the company, a number that represents the total value of a company, while also considering cash and debt.

Right now, investing in cannabis stocks is risky because of the industry’s unsettled legal status and lack of regulatory framework. And, any gains are likely to be on the smaller side while most cannabis investors are relegated to the pink sheets. However, as with any investment, research is key. Be sure to check out the management teams of the companies to ensure they have solid reputations and a record of ethical success. If cannabis becomes federally legal, companies could list on mainstream markets like the NASDAQ or the New York Stock Exchange. In which case, in the voice of Effie Trinket, “may the odds be ever in your favor.”

Do you have any experience with cannabis stocks or a hot tip for fellow investors? Share your feedback in the comments below!