Monday October 24, 2016

News

News

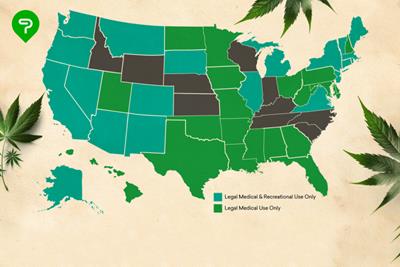

Four states and Washington, DC have legalized recreational marijuana. In Colorado, Oregon, and Washington, sales have already been underway for over two years now. Alaska issued its first retail license in early September, with sales expected to start in October.

This November, nine states will be voting on some form of marijuana legalization. Of those, five will be voting on recreational use – most notably, California. Sales are progressing at a rapid pace, with Oregon’s monthly sales doubling in less than six months. So it’s safe to say that the cannabis industry has momentum, both politically and economically.

One of the primary selling points for legalization has been the potential tax revenues. In Washington, cannabis was originally taxed at 25% three times before being sold to the consumer, making for an extraordinarily high effective rate. This may have been sustainable while Washington was the only state in the Northwest with legal weed, but with Oregon coming on, the state has since simplified the tax framework to a basic 37% retail tax. In Oregon, where medical dispensaries have been temporarily permitted to sell to recreational consumers since last October, a 25% sales tax was imposed in January of this year. When the Oregon Liquor Control Commission assumes full control of the recreational marijuana program at the beginning of 2017, that will fall to 17% plus local taxes of up to 3%.

So how do each of the states that have legalized compare to each other on taxes? Where does the money go? And what does this all mean for the consumer at a dispensary?

Colorado

Colorado has the honor of being the first state to legalize recreational cannabis, with the passage of Amendment 64 in 2012 and sales beginning in January 2014. (Washington didn’t allow sales until July of that year.) Taxes on Colorado cannabis are significant, including a 2.9% general sales tax that also applies to medical sales, a 10% special retail sales tax on recreational cannabis, and a further 15% excise tax on wholesale transactions. The 10% special tax will be lowered to 8% next summer, according to Adam Koh at Cannabis Benchmarks and 3C Consulting.

In 2015, the state collected $129 million of revenue from these taxes. In Denver, which levies its own taxes adding up to over 8% of retail price, this makes for an effective tax rate of about 30%, according to 9News Denver. The average consumer in Denver buying a thirty-dollar eighth will pay over $6 in taxes, and that doesn’t include the 15% wholesale tax. In terms of gross tax revenue, cannabis tops the list of sin taxes, with casinos, liquor, and tobacco all bringing in less Revenue.

So where does all that money go? The three state taxes mentioned above are allocated separately: The 2.9% general sales tax goes directly to the state’s general fund. Of the wholesale tax, the first $40 million is allocated to a fund for public school capital projects, with the remainder going toward the Public School Fund. Finally, 15% of the special sales tax is allocated to local governments and the remaining 85% is allocated to the Marijuana Tax Cash Fund. The Fund is used for health and health education, substance abuse treatment, and law enforcement. All revenues from cannabis add up to just over 1% of state revenues.

It is important to note that if you are planning to travel to Colorado for some cannatourism, how much you pay can differ significantly based on locale. Denver, as mentioned, imposes significant sales taxes of its own on top of the state taxes.

Oregon

Oregon currently imposes a sales tax of 25% on sales from medical (pdf) dispensaries to recreational consumers (pdf).This will fall to a state special sales tax of 17% in January 2017, with local governments permitted to impose additional sales taxes of up to 3%. These are the only taxes on cannabis in Oregon, as the state has no sales tax.

As of late August, Oregon had collected almost $26 million in taxes from marijuana sales in 2016.

Oregon’s allocation framework is simpler than Colorado’s:

- 40% for the Common School Fund, which assists local school districts

- 20% go to mental health and drug treatment services

- 15% to the state police

- 20% to city/county law enforcement

- 5% to Oregon Health Authority prevention and treatment services

The average price of an eighth in Oregon is around $30-35, so the average consumer would pay a little over $8 in taxes compared to a little over $6 in Colorado.

Washington

As mentioned, Washington originally imposed steep taxes of 25% at three stages of production. 0By lowering taxes to a flat 37% retail tax in June 2015, the state didn’t just simplify its cannabis tax code -- it also helped cannabusinesses pay less in federal income taxes. Before, under the 25% scheme, businesses had to pay federal income tax on the state taxes due to wording requiring that it be reported as income. Now, with the 37% rate, businesses can treat it as a sales tax and avoid paying federal income taxes on it.

Beginning in fiscal year 2016 and continuing through 2017, Washington will allocate $6 million of cannabis tax revenues to local government which have licensed marijuana businesses. It appears that the remainder is deposited in the state’s general fund. Beginning in 2018, however, the state’s framework changes. If revenues exceed $25 million, 30% of revenues will be distributed to local governments. Of that 30%, a third will be allocated based on proportion of sales occurring within the municipality’s jurisdiction. The remainder will be allocated on a per- capita basis to governments that permit cannabis businesses to operate. Washington’s average price for one gram is about $13, slightly higher than other states. For an eighth, that would come out to almost $40. Taxed at 37%, this means that the average consumer will pay a whopping $15 in taxes!

Alaska

Alaska hasn’t started selling weed yet, with the first licensed dispensary expected to being sales in later this month. The state has a different tax framework than others, charging a simple $50/oz wholesale tax when a cultivator sells to a retailer or producer. In July, the state passed a bill which allocated half of projected tax revenues to drug and domestic violence treatment services. If revenues from cannabis fail to cover the amounts allocated, it can be shored up instead with funds taken from alcohol taxes.

It’s difficult to say prospectively what Alaska’s cannabis prices will look like once sales begin. Since the state is only imposing a wholesale tax, technically consumers won’t be paying any taxes at all. Of course, economics teaches us that it really doesn’t matter who officially pays the tax, since tax incidence depends on relative elasticities of supply and demand. For the sake of argument, however, we might loosely say that about $6.25 ($50 divided by 8) will be paid by consumers in taxes for an eighth. If an eighth goes for $30, this would put Alaska’s effective tax rate at about 21% -- comparable to other states.

Washington, DC

With passage of Initiative 71 in 2014, recreational marijuana became legal to possess, use, and grow in the nation’s capital. Unfortunately, the initiative does not permit recreational sales, and Congress passed an appropriations amendment which blocked the DC Council from passing any legislation to do so. This rider expired on September 30, but it is yet unclear whether the Council will take any steps to create a licensing and regulatory framework.

The appeal of high tax revenues were a major driver of legalization and will continue to be a major factor as we turn to larger states to legalize in a few weeks. As it stands, in Washington, consumers are paying $15 in taxes per eighth, $8 in Oregon and $6 in Colorado. Only time will tell what the tax rates will be as new states legalize recreational marijuana.

Photo Credit: Pictures of Money (license)